Table of Content

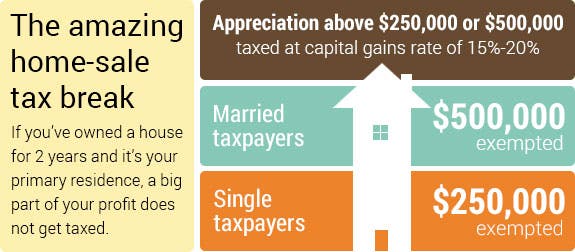

Fortunately, the Taxpayer Relief Act of 1997 provides some relief to homeowners who meet certain IRS criteria. For single tax filers, up to $250,000 of the capital gains can be excluded, and for married tax filers filing jointly, up to $500,000 of the capital gains can be excluded. For gains exceeding these thresholds, capital gains rates are applied. If you sell below-market to a relative or friend, the transaction may subject the recipient to taxes on the difference, which the IRS may consider a gift.

By comparison, states with high income tax California, New York, Oregon, Minnesota, New Jersey and Vermont) also have high taxes on capital gains too. A good capital gains calculator, like ours, takes both federal and state taxation into account. You have to pay taxes on any portion of your home sale that does not meet the requirements for a home sale exclusion. The home must be your primary residence and you must have lived in and owned it for at least two of the last five years, though your ownership and residency don't need to be simultaneous. You can exclude up to $250,000 in profits ($500,000 for married couples) for a home that meets these requirements.

What About Foreclosure or a Short Sale?

According to the Housing Assistance Tax Act of 2008, a rental property converted to a primary residence can only have the capital gains exclusion during the term when the property was used as a principal residence. Most commonly, real estate is categorized as investment or rental property or as a principal residence. An owner’s principal residence is the real estate used as the primary location in which they live. But what if the home you are selling is an investment property, rather than your principal residence?

If your goal in buying an asset is to sell it to another investor at a future date for a higher price, then you'll generally be subject to capital gains tax when you sell. The two years don’t need to be consecutive, but house-flippers should beware. If you sell a house that you didn’t live in for at least two years, the gains can be taxable. Selling in less than a year is especially expensive because you could be subject to the short-term capital gains tax, which is higher than long-term capital gains tax.

Why should I hold the house for two years before selling?

Therefore, if you have two homes and lived in each for at least two of the last five years, you won’t be able to sell both of them tax free until more than two years have passed since you sold the first one. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. You need to have kept adequate documentation of all your purchases, including those that were made through the dividend reinvestment plan, in order to establish the basis of these shares.

Section 121 is a provision of the tax code that allows home sellers to exclude a certain amount of their gains from taxation. It applies if they’re selling a primary residence and meet other requirements. The taxes will be calculated based on the sale price, less what you paid for the property . Just like a second home, the tax rate will be based on whether the property was held for more or less than a year. The IRS warns that homeowners should fully vet a 1031 Accommodator and beware of schemes as there have been instances of these sales falling through or not meeting IRS requirements.

Public Facts and Zoning for 1278 Capital Gains #1

Enrollment in, or completion of, the H&R Block Income Tax Course or Tax Knowledge Assessment is neither an offer nor a guarantee of employment. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. The Income Tax Course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. Additional time commitments outside of class, including homework, will vary by student.

Form 1099-S is an IRS tax form reporting the sale or exchange of real estate. This form is usually issued by the real estate agency, closing company, or mortgage lender. If you meet the IRS qualifications for not paying capital gains tax on the sale, inform your real estate professional by Feb. 15 following the year of the transaction. Being classified as an investment property, rather than as a second home, affects how it’s taxed and which tax deductions, such as mortgage interest deductions, can be claimed. Under the Tax Cuts and Jobs Act of 2017, up to $750,000 of mortgage interest on a principal residence or vacation home can be deducted. However, if a property is solely used as an investment property, it does not qualify for the capital gains exclusion.

Tax Deductions For Homeowners: Your Breaks And Benefits

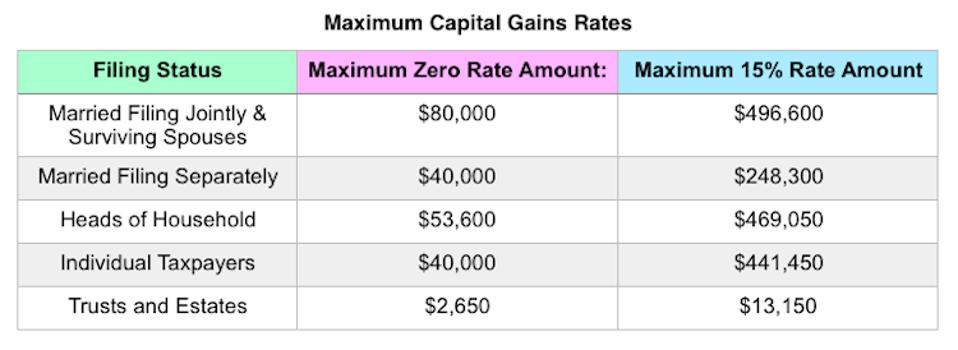

The most common ways to reduce capital gains tax exposure include 1031 exchanges, converting a rental property to a primary residence, tax-loss harvesting, and monetized asset sales. If you are required to pay capital gains tax, you pay the tax when you sell your property. However, the capital gains tax is dependent on several factors, including your current tax bracket, the length of time you’ve owned and occupied the property, and whether the house is your primary residence.

They are not tax efficient and an investor should consult with his/her tax advisor prior to investing. The value of the investment may fall as well as rise and investors may get back less than they invested. State taxes must also be included on your capital gains.

Qualified distributions from those are tax-free; in other words, you don’t pay any taxes on investment earnings. With traditional IRAs and 401s, you’ll pay taxes when you take distributions from the accounts in retirement. This can include investments, such as stocks, bonds or cryptocurrency, real estate, cars, boats and other tangible items. By providing this information, Redfin and its agents are not providing advice or guidance on flood risk, flood insurance, or other climate risks. Redfin strongly recommends that consumers independently investigate the property’s climate risks to their own personal satisfaction. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

The 1031 exchange allows for the tax on the gain from the sale of a property to be deferred, rather than eliminated. If the FMV of the property at the time the donor made the gift is less than the donor's adjusted basis, your adjusted basis depends on whether you have a gain or loss when you dispose of the property. Treat worthless securities as though they were capital assets sold or exchanged on the last day of the tax year. Tax-loss harvesting, which involves selling losing investments to offset the gains from winners. If you inherit a home, you don't get the $250,000 exemption unless you've owned the house for at least two years as your primary residence. But you can still get a break if you don't meet that criteria.

Let’s explore other ways to reduce or avoid capital gains taxes on home sales. Most states tax capital gains according to the same tax rates they use for regular income. So, if you're lucky enough to live somewhere with no state income tax, you won't have to worry about capital gains taxes at the state level. Almost everything you own and use for personal or investment purposes is a capital asset. Examples include a home, personal-use items like household furnishings, and stocks or bonds held as investments. When you sell a capital asset, the difference between the adjusted basis in the asset and the amount you realized from the sale is a capital gain or a capital loss.

Your new cost basis will increase by the amount that you spent to improve your home. Improvements that are necessary to maintain the home with no added value, have a useful life of less than one year, or are no longer part of your home will not increase your cost basis. The main major restriction is that you can only benefit from this exemption once every two years.

Realized1031.com is a website operated by Realized Technologies, LLC, a wholly owned subsidiary of Realized Holdings, Inc. (“Realized”). Realized Financial is a subsidiary of Realized Holdings, Inc. ("Realized"). Check the background of this firm on FINRA's BrokerCheck. Add any expenditures you've made in order to improve the quality of the property or other items that increase the basis. Bank products and services are offered by Pathward, N.A. US Mastercard Zero Liability does not apply to commercial accounts .

No comments:

Post a Comment